Declining balance method formula

The book value of the. What is the formula for calculating the double-declining balance.

Double Declining Balance Method Prepnuggets

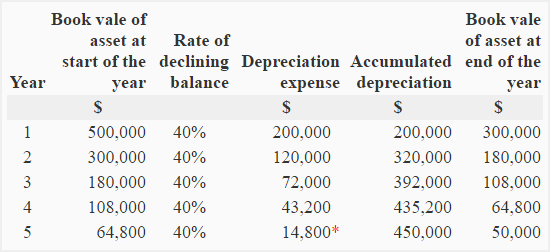

Assuming an asset has a life of five years and the declining balance rate is 150 percent the accelerated depreciation rate is 30 percent which is 100 percent divided by 5 multiplied by 15.

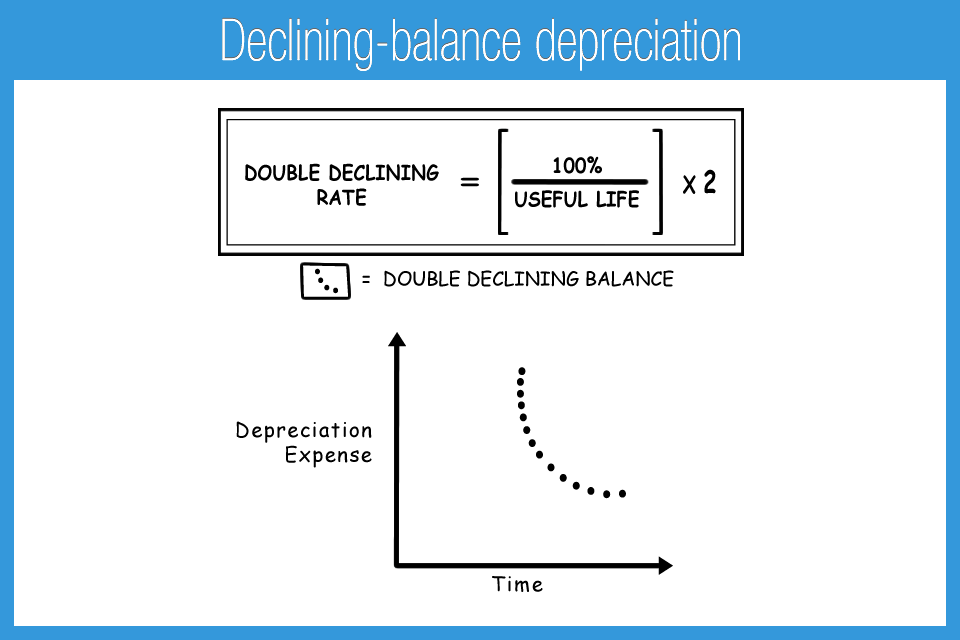

. The declining balance technique represents the opposite of the straight-line depreciation method which is more suitable for assets whose book value drops at a steady. Calculating a double declining balance is not complex although it requires some considerations. Depreciation 2 x depreciation rate x beginning period book value You.

Declining balance method calculates the depreciation on the basis of assets net book value. The formula for determining depreciation value using the declining balance method is- Depreciation Value. Declining Balance Rate 2 20 40 Depreciation 40 20000 8000 Example 2 Referring to Example 1 calculate the depreciation of the asset for the second year.

The double declining balance rate 2 x straight line depreciation rate. The VDB Function 1 is an Excel Financial function that calculates the depreciation of an asset using the Double Declining Balance DDB method or some other method specified. Double declining balance rate 2 x 20 40.

Double Declining Balance Method formula 2 Book Value of Asset at Beginning SLM Depreciation rate. The formula for calculating depreciation value using declining balance method is Depreciation per annum Net Book Value - Residual Value x Depreciation Rate Net Book. This value is then multiplied by a factor declining.

The following is the formula Declining balance formula. All the previous steps are integral to determining the information you require for the following formula. Straight line depreciation rate 15 02 or 20.

Declining balance depreciation formula Declining balance depreciation Net book value x Depreciation rate Net book value is the carrying value of fixed assets after deducting the. The spreadsheet formula in cell A7 shows one divided by the number of years to determine the straight line percentage. The formula for depreciation under the double-declining method is as follows.

Meaning accountants first determine assets carrying amount for the period which is calculated. Depreciation Expenses Net Books Residual Value Depreciation Rate Depreciation expenses are the expenses that charged to. Net Book Value Scrap Value x Depreciation Rate.

Double Declining Balance Method Of Depreciation Accounting Corner

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

Depreciation Formula Examples With Excel Template

Declining Balance Depreciation Calculator

Declining Balance Method Of Depreciation Examples

Double Declining Balance Depreciation Method Youtube

What Is The Double Declining Balance Ddb Method Of Depreciation

Depreciation Formula Calculate Depreciation Expense

Simple Tutorial Double Declining Balance Method Youtube

Double Declining Balance Depreciation Daily Business

Declining Balance Method Of Depreciation Definition Explanation Formula Example Accounting For Management

Double Declining Balance Method Of Depreciation Accounting Corner

How To Use The Excel Db Function Exceljet

Declining Balance Depreciation Double Entry Bookkeeping

Profitable Method Declining Balance Depreciation

Declining Balance Method Of Depreciation Formula Depreciation Guru